Cryptocurrency definition

A hard fork is a protocol upgrade that is not backward compatible. This means every node (computer connected to the Bitcoin network using a client that performs the task of validating and relaying transactions) needs to upgrade before the new blockchain with the hard fork activates and rejects any blocks or transactions from the old blockchain. https://allaboutfireprotection.net/ The old blockchain will continue to exist and will continue to accept transactions, although it may be incompatible with other newer Bitcoin clients.

Each of our coin data pages has a graph that shows both the current and historic price information for the coin or token. Normally, the graph starts at the launch of the asset, but it is possible to select specific to and from dates to customize the chart to your own needs. These charts and their information are free to visitors of our website. The most experienced and professional traders often choose to use the best crypto API on the market. Our API enables millions of calls to track current prices and to also investigate historic prices and is used by some of the largest crypto exchanges and financial institutions in the world. CoinMarketCap also provides data about the most successful traders for you to monitor. We also provide data about the latest trending cryptos and trending DEX pairs.

Een mempool is een register van alle BTC-transacties die nog niet zijn gevalideerd door een miner en toegevoegd aan het volgende blok op de blockchain. Een mempool wordt tijdelijk opgeslagen op elke individuele node op het netwerk en werkt als een soort van bufferzone of wachtkamer voor bitcointransacties die nog moeten worden uitgevoerd.

Cryptocurrency trading platform

Low-volume markets could cost you on sales. If there’s not a lot of volume and you put an order in, that’s called slippage. You could end up buying at a higher price or selling at a lower price than you’d want.

Cryptocurrency exchanges make money in a handful of different ways. They can either charge fees for transactions, charge additional trading fees, earn interest by lending crypto to traders, charge listing fees for tokens or coins listed on their platform, earn a profit through market making (providing users liquidity) or any combination thereof.

Some crypto enthusiasts object to centralized exchanges because they go against the decentralized ethos of cryptocurrency. Even worse in the eyes of some crypto users, the company or organization may require users to follow Know Your Customer (KYC) rules. These require each user to divulge their identity, much as you would when you apply for a bank account, to combat money laundering and fraud.

Cryptocurrency exchanges operate similarly to other central exchanges, such as traditional online brokerages. With the price of Bitcoin touching new all-time highs of over $90,000 in November 2024, the best crypto exchanges offer you all the tools needed to research and invest in Bitcoin and other cryptocurrencies such as Shiba Inu or Dogecoin. In addition to providing a platform to securely buy and sell digital currencies and tokens, many crypto exchanges offer additional crypto investment services, such as staking, lending, and digital asset custody.

Gemini is well suited for crypto traders of any skill level. The platform is packed to the brim with scores of features, like its unique Gemini Earn program for earning interest on crypto holdings and the Gemini Credit Card. Another major plus is Gemini is available in all 50 states, and the company says it has a strong commitment to meeting all U.S. regulatory compliance requirements.

While you’re ideally picking an exchange with the lowest costs, dwelling too much on the ins and outs of maker and taker fees can be counterproductive. That’s because you can’t choose whether your order is processed as a maker or a taker. Instead, you’re better served considering overall fees and any discounts available for trading a certain amount each month or holding an exchange’s native cryptocurrency.

Cryptocurrency prices

Another point that Bitcoin proponents make is that the energy usage required by Bitcoin is all-inclusive such that it encompasess the process of creating, securing, using and transporting Bitcoin. Whereas with other financial sectors, this is not the case. For example, when calculating the carbon footprint of a payment processing system like Visa, they fail to calculate the energy required to print money or power ATMs, or smartphones, bank branches, security vehicles, among other components in the payment processing and banking supply chain.

Het totale cryptomarktvolume van de afgelopen 24 uur is €215.08B, wat een afname is van 24.57%. Het totale volume in DeFi is momenteel €8.89B, 4.14% van het totale cryptomarktvolume in de afgelopen 24 uur. Het volume van alle stablecoins is nu €199.65B, wat 92.83% van het totale cryptomarktvolume in de afgelopen 24 uur is.

NFT’s zijn afbeeldingen met meerdere gebruiken die worden opgeslagen op een blockchain. Ze kunnen worden gebruikt als kunst, een manier om QR-codes te delen, ticketing en nog veel meer dingen. Het eerste opvallende gebruik was voor kunst, met projecten zoals CryptoPunks en Bored Ape Yacht Club die grote aanhang kregen. We lijsten ook alle top NFT collecties die beschikbaar zijn. We verzamelen de laatste verkoop- en transactiegegevens, plus aankomende NFT collectie lanceringen onchain. NFT’s zijn een nieuw en innovatief deel van het crypto-ecosysteem dat het potentieel heeft om veel bedrijfsmodellen te veranderen en bij te werken voor de Web 3 wereld.

Bitcoin is becoming more political by the day, particularly after El Salvador began accepting the currency as legal tender. The country’s president, Nayib Bukele, announced and implemented the decision almost unilaterally, dismissing criticism from his citizens, the Bank of England, the IMF, Vitalik Buterin and many others. Since the Bitcoin legal tender law was passed in September 2021, Bukele has also announced plans to build Bitcoin City, a city fully based on mining Bitcoin with geothermal energy from volcanoes.

Since its inception, Ethereum has maintained its spot as the second-largest cryptocurrency by market capitalization. But like every other blockchain network that exists, Ethereum is not perfect. Notable, the legacy blockchain is plagued with high gas fees and low throughput of between 15 to 30 transactions per second.

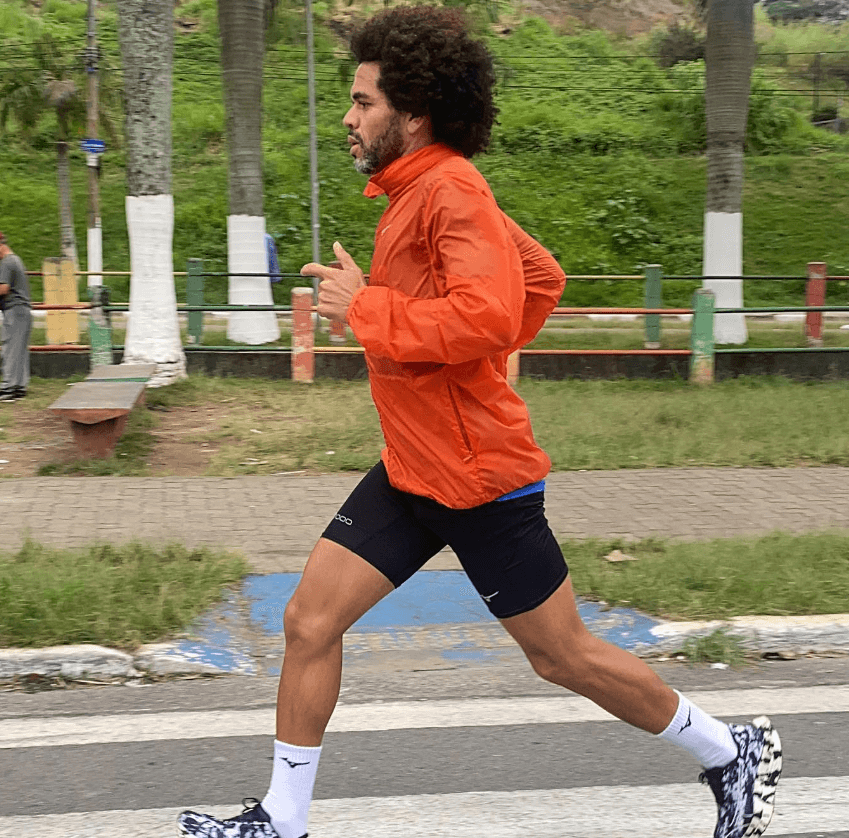

Afonso é um profissional dedicado ao universo da corrida, com um foco especial na biomecânica e na nutrição esportiva. Como ex-atleta e formado em Fisioterapia, Afonso entende profundamente a importância de um bom par de tênis e uma dieta balanceada para um desempenho de corrida otimizado