Cryptocurrency

Proof of stake, on the other hand, has validators that “stake” cryptocurrency on a certain transaction for block creation. By staking their assets they are entered into a lottery-style selection process, and, if chosen, the validator will receive payment in the form of the transaction costs. https://pincollectorssite.com/ Proof of stake is generally fairer as it requires less amassed computational power, meaning those with more resources don’t hold a monopoly on verification — which often happens with proof of work systems. It’s a compelling system, so much that Ethereum is making the shift to a proof of stake in 2022. Without the mining feature of proof of stake systems, though, all of the currency has to be pre-mined instead of the steady mining and production of a coin like Bitcoin.

Some cryptocurrencies offer their owners the opportunity to earn passive income through a process called staking. Crypto staking involves using your cryptocurrencies to help verify transactions on a blockchain protocol. Though staking has its risks, it can allow you to grow your crypto holdings without buying more.

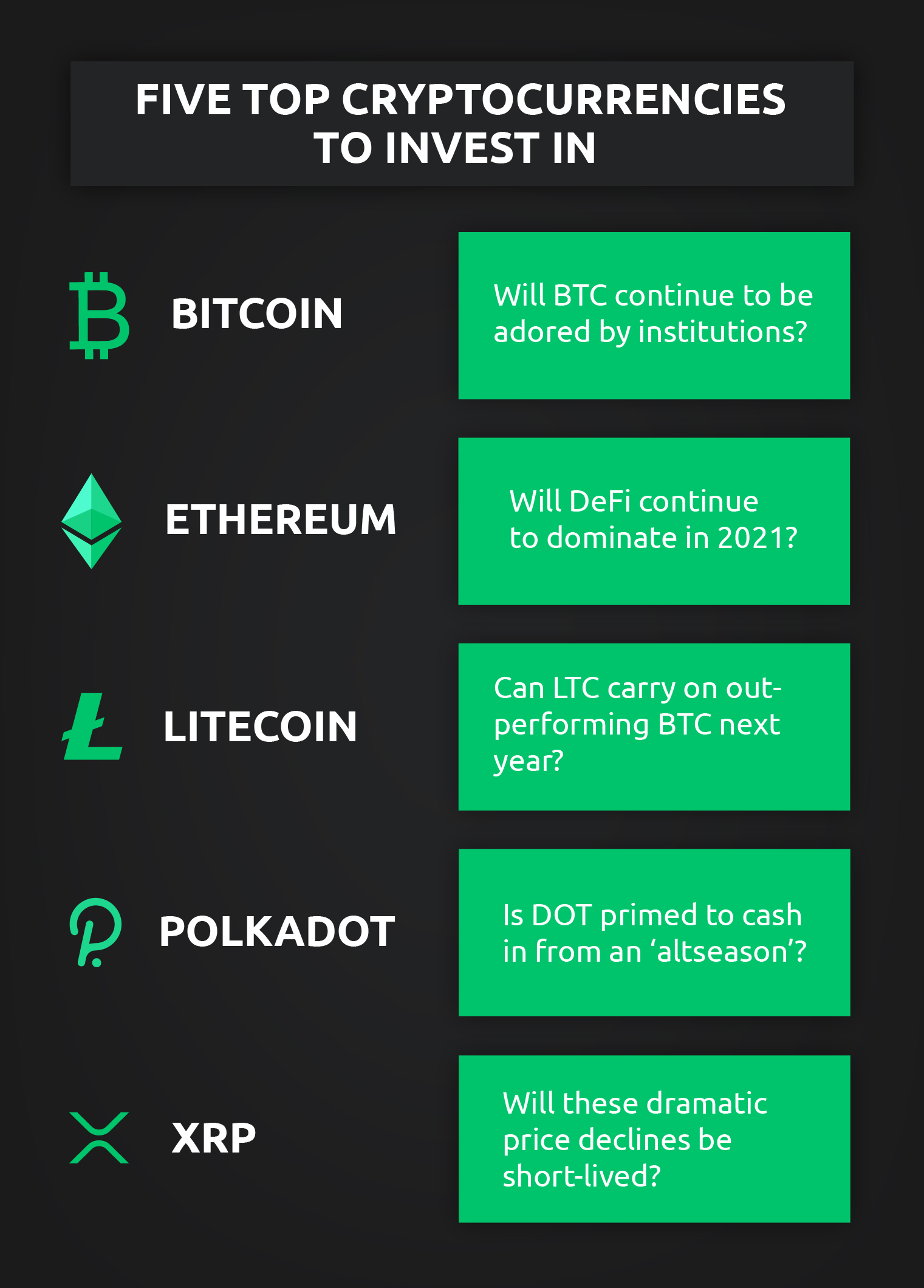

Most of the time, when you hear about cryptocurrency types, you hear the coin’s name. However, coin names differ from coin types. Here are some of the types you’ll find with some of the names of tokens in that category:

Cryptocurrency makes legal enforcement against extremist groups more complicated, which consequently strengthens them. White supremacist Richard Spencer went as far as to declare bitcoin the “currency of the alt-right”.

Cryptocurrency meaning

It can take a lot of work to comb through a prospectus; the more detail it has, the better your chances it’s legitimate. But even legitimacy doesn’t mean the currency will succeed. That’s an entirely separate question, and that requires a lot of market savvy. Be sure to consider how to protect yourself from fraudsters who see cryptocurrencies as an opportunity to bilk investors.

Another advantage of cryptocurrency is that it’s global, so there’s no need to figure or pay foreign exchange rates, although cryptocurrency isn’t legal in some countries. You also don’t need to worry about bank account restrictions, such as ATM withdrawal limits.

Despite these risks, cryptocurrencies have seen a significant price leap, with the total market capitalization rising to about $2.4 trillion. Despite the asset’s speculative nature, some have created substantial fortunes by taking on the risk of investing in early-stage cryptocurrencies.

Look before you leap! Before investing in a cryptocurrency, be sure you understand how it works, where it can be used, and how to exchange it. Read the webpages for the currency itself (such as Ethereum, Bitcoin or Litecoin) so that you fully understand how it works, and read independent articles on the cryptocurrencies you are considering as well.

According to Consumer Reports, all investments carry risk, but some experts consider cryptocurrency to be one of the riskier investment choices out there. If you are planning to invest in cryptocurrencies, these tips can help you make educated choices.

Top cryptocurrency

The total crypto market volume over the last 24 hours is $239.35B, which makes a 14.14% increase. The total volume in DeFi is currently $11.59B, 4.84% of the total crypto market 24-hour volume. The volume of all stable coins is now $216.31B, which is 90.37% of the total crypto market 24-hour volume.

The closest second to Bitcoin is Ethereum, and its token which is called “Ether.” The Ethereum network is intended to replace traditional financial services firms like banks and brokerages by using decentralized applications, commonly called “DeFi,” for financial applications. Ether is the fuel that is required to run transactions on the Ethereum blockchain.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

The total crypto market volume over the last 24 hours is $239.35B, which makes a 14.14% increase. The total volume in DeFi is currently $11.59B, 4.84% of the total crypto market 24-hour volume. The volume of all stable coins is now $216.31B, which is 90.37% of the total crypto market 24-hour volume.

The closest second to Bitcoin is Ethereum, and its token which is called “Ether.” The Ethereum network is intended to replace traditional financial services firms like banks and brokerages by using decentralized applications, commonly called “DeFi,” for financial applications. Ether is the fuel that is required to run transactions on the Ethereum blockchain.

Cryptocurrency

Cryptocurrencies are usually built using blockchain technology. Blockchain describes the way transactions are recorded into “blocks” and time stamped. It’s a fairly complex, technical process, but the result is a digital ledger of cryptocurrency transactions that’s hard for hackers to tamper with.

Gedurende de eerste jaren dat cryptogeld bestond kreeg het geleidelijk meer aandacht in de media en van het publiek. Vooral periodes waarin de koers van bitcoin snel steeg, trokken de aandacht. Dat gebeurde bijvoorbeeld in 2013, toen de munt voor het eerst in de buurt van 1.000 dollar kwam. De pieken in 2017 (ca 20.000 dollar) en 2021 (ruim 60.000 dollar) zorgden opnieuw voor veel belangstelling. Nadruk lag op die momenten vooral op het speculatieve aspect.

TThe data at CoinMarketCap updates every few seconds, which means that it is possible to check in on the value of your investments and assets at any time and from anywhere in the world. We look forward to seeing you regularly!

The European Commission published a digital finance strategy in September 2020. This included a draft regulation on Markets in Crypto-Assets (MiCA), which aimed to provide a comprehensive regulatory framework for digital assets in the EU.

An important factor to consider is fees. These include potential deposit and withdrawal transaction fees plus trading fees. Fees will vary by payment method and platform, which is something to research at the outset.

Afonso é um profissional dedicado ao universo da corrida, com um foco especial na biomecânica e na nutrição esportiva. Como ex-atleta e formado em Fisioterapia, Afonso entende profundamente a importância de um bom par de tênis e uma dieta balanceada para um desempenho de corrida otimizado