Top 20 cryptocurrency

Als Entschädigung für die Nutzung ihrer Rechenressourcen erhalten Miner Belohnungen für jeden Block, den sie erfolgreich der Blockchain hinzufügen. Zum Zeitpunkt der Einführung von Bitcoin betrug die Belohnung 50 Bitcoins pro Block: diese Zahl halbiert sich mit jeden 210.0 https://cholonoir.com/ 00 Blocks, die neu geschürft werden — was etwa vier Jahre dauert. Zum jetzigen Stand (2020) ist der Block Reward dreimal halbiert worden und beläuft sich auf 6,25 Bitcoins.

Monederos de papel: si eres de los que prefiere las cosas a la antigua, puedes escribir tu dirección Bitcoin en una hoja de papel o imprimirla. Este tipo de almacenamiento de claves privadas no está libre de riesgos. Si pierdes tu billetera de papel, tus BTC podrían perderse para siempre.

La configuración de una cuenta es similar a crear una cuenta para un servicio en línea, aunque los usuarios normalmente necesitarán completar los campos de Know Your Customer(KYC) subiendo al formulario una copia de su identificación oficial.

Aunque las carteras de hardware son un poco más difíciles de usar que sus homólogos de software, se consideran la forma más segura de almacenar criptomonedas, ya que son inmunes a ciberataques y malwares informáticos. Muchos modelos conocidos de monedero de hardware vienen con una aplicación de escritorio complementaria que proporciona una interfaz fácil de usar.

Das Source Code Repository von Bitcoin auf GitHub listet mehr als 750 Mitwirkende auf, einige der wichtigsten sind Wladimir J. van der Laan, Marco Falke, Pieter Wuille, Gavin Andresen, Jonas Schnelli und andere.

Cryptocurrency wallets

Public key: Your public key is like an address that others can use to send cryptocurrency to your wallet. It’s similar to a bank account number that you can share freely. Anyone can send funds to this address, but it doesn’t grant access to your assets.

Some wallets fully validate transactions and blocks. Almost all full nodes help the network by accepting transactions and blocks from other full nodes, validating those transactions and blocks, and then relaying them to further full nodes.

Public key: Your public key is like an address that others can use to send cryptocurrency to your wallet. It’s similar to a bank account number that you can share freely. Anyone can send funds to this address, but it doesn’t grant access to your assets.

Some wallets fully validate transactions and blocks. Almost all full nodes help the network by accepting transactions and blocks from other full nodes, validating those transactions and blocks, and then relaying them to further full nodes.

Private key: Your private key is the most critical part of a crypto wallet. It acts like a password or digital signature that enables you to access and control your cryptocurrency. Your private key must remain secure and private because if someone gains access to it, they can control your funds.

Owning a cryptocurrency wallet means you have full control over your assets. Unlike keeping funds on an exchange, which can be subject to hacks and shutdowns, a wallet allows you to manage your cryptocurrency independently.

How to invest in cryptocurrency

When you think of investing in cryptocurrency, you might think about buying and holding one or more crypto coins. Buying cryptocurrency directly is probably the most common way to add crypto exposure to your portfolio, but when it comes to investing in cryptocurrency, you have a few different options:

Nonetheless, there are a huge number of opportunities to invest and profit through DeFi products and platforms — whether that be by speculating on their native assets, leveraging them for passive income, providing liquidity or something else.

Some of the more popular smart contract-capable blockchains currently include Ethereum, Binance Smart Chain, Solana and Avalanche. Each of these has its own array of popular DApps, many of which are genuinely useful and secure, while others are less so. You’ll also need a separate wallet to interact with each.

When you think of investing in cryptocurrency, you might think about buying and holding one or more crypto coins. Buying cryptocurrency directly is probably the most common way to add crypto exposure to your portfolio, but when it comes to investing in cryptocurrency, you have a few different options:

Nonetheless, there are a huge number of opportunities to invest and profit through DeFi products and platforms — whether that be by speculating on their native assets, leveraging them for passive income, providing liquidity or something else.

Some of the more popular smart contract-capable blockchains currently include Ethereum, Binance Smart Chain, Solana and Avalanche. Each of these has its own array of popular DApps, many of which are genuinely useful and secure, while others are less so. You’ll also need a separate wallet to interact with each.

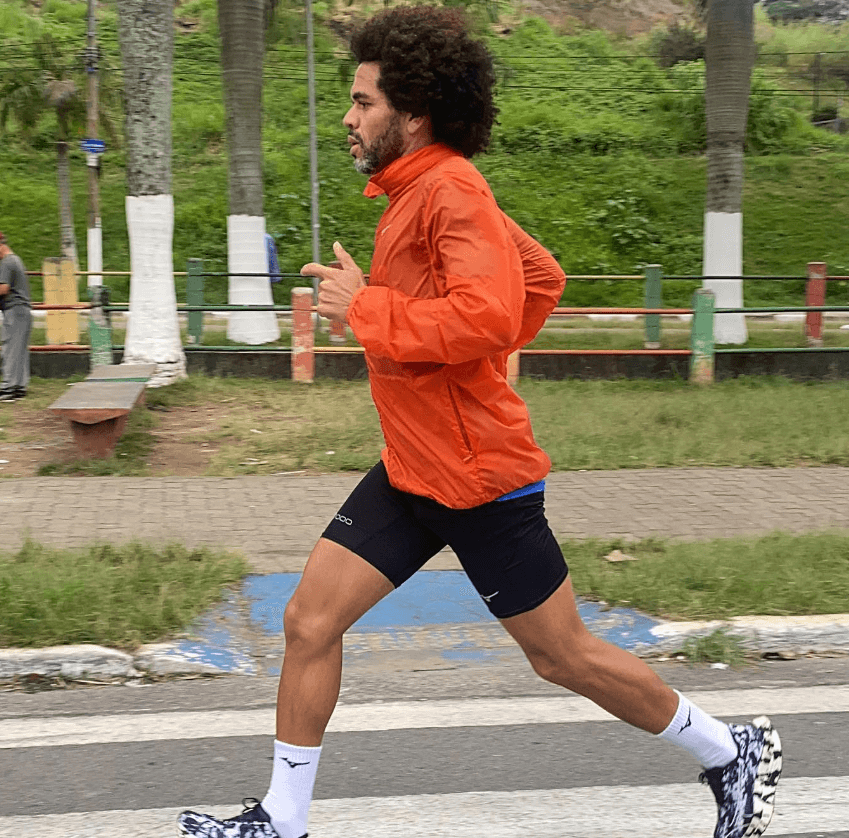

Afonso é um profissional dedicado ao universo da corrida, com um foco especial na biomecânica e na nutrição esportiva. Como ex-atleta e formado em Fisioterapia, Afonso entende profundamente a importância de um bom par de tênis e uma dieta balanceada para um desempenho de corrida otimizado