Cryptocurrency rate

Investing in cryptocurrency has long been a divisive topic. An emerging asset class, crypto can see dramatic price moves, making it a risky but potentially rewarding option for investors to add to their portfolio. https://casino-888.org Before you consider investing in cryptoassets, it’s important that you first learn what they are and why they might be a good investment opportunity. Discover the risks of cryptocurrency trading and whether you should believe some of the common myths about crypto.

Nonetheless, there are a huge number of opportunities to invest and profit through DeFi products and platforms — whether that be by speculating on their native assets, leveraging them for passive income, providing liquidity or something else.

A best practice among investors is to periodically review your entire portfolio to assess the need to rebalance your holdings. That might mean increasing or scaling back your crypto exposure, depending on your investment goals and other financial needs.

Bitcoin cryptocurrency

Bitcoin is een gedecentraliseerde cryptocurrency die oorspronkelijk werd beschreven in een whitepaper uit 2008 door een persoon of een groep mensen, onder de alias Satoshi Nakamoto. Het werd kort hierna gelanceerd in januari 2009.

Naast deze drie basissoorten, kunnen bitcoinwallets gebruik maken van single-key of multisig technologie. Ze worden ook verder onderverdeeld als “hot” of “cold” opslagmethoden: een hot wallet is verbonden met het internet, terwijl een cold wallet volledig offline is.

Papieren Wallet: als je echt ouderwets wil zijn, kun je je bitcoinadres opschrijven op een papiertje — of deze uitprinten. Deze aanpak is niet risicoloos. Als je je papieren wallet verlies, kan je BTC voor altijd verloren gaan.

On the flip side, countries like China have moved to heavily clamp down on Bitcoin mining and trading activities. In May 2021, the Chinese government declared that all crypto-related transactions are illegal. This was followed by a heavy crackdown on Bitcoin mining operations, forcing many crypto-related businesses to flee to friendlier regions.

The entire cryptocurrency market — now worth more than $2 trillion — is based on the idea realized by Bitcoin: money that can be sent and received by anyone, anywhere in the world without reliance on trusted intermediaries, such as banks and financial services companies.

Cryptocurrency exchange

Crypto.com is a relatively new player in the scene, but has been rapidly making waves with their aim to blend Centralized Exchanges with DeFi a bit by offering a companion wallet app with free withdrawals from the centralized exchange to the companion wallet. Their companion wallet also supports staking and DeFi liquidity pools, without lockups, directly from the wallet app, though I was unable to determine exactly what coins were supported for the staking options.

Passive yield wise, Coinbase offers in-house staking of a handful of coins, with no lockup times, though they do take a reasonably high cut of the rewards in the process (~25% of the staking rewards).

Like Binance, Huobi offers yield farming services by essentially contracting them out in various offerings with lockups. Liability is again placed squarely on your shoulders, and you have to take a more active role in picking which contracts to commit to.

While KuCoin technically does not serve US customers on paper, they do not implement any KYC policies and generally have a somewhat openly stated ‘wink wink nudge nudge’ kind of philosophy about servicing places they technically shouldn’t.

Coinberry is a high-liquidity brokerage that allows sellers to place crypto orders on the market and make a profit in CAD. They have even launched and offer a payment processing solution known as Coinberry Pay, which can be used by merchants and traders who want to accept cryptocurrency payments. It is one of the few local exchanges that is registered with Canada’s main financial regulator FINTAC, and is fully compliant with all AML policies and regulatory frameworks. It also offers CDIC insured segregated banking, meaning that company money and customer funds are never combined.

Primarily active in the Chinese and other Asian markets, Huobi is one of the largest exchanges by volume. However, there is significant question around if those volume numbers are legitimate, or inflated by wash trading or false reporting, but such things aside, they offer a massive coin selection at competitive rates, fiat trading, and margin/options trading.

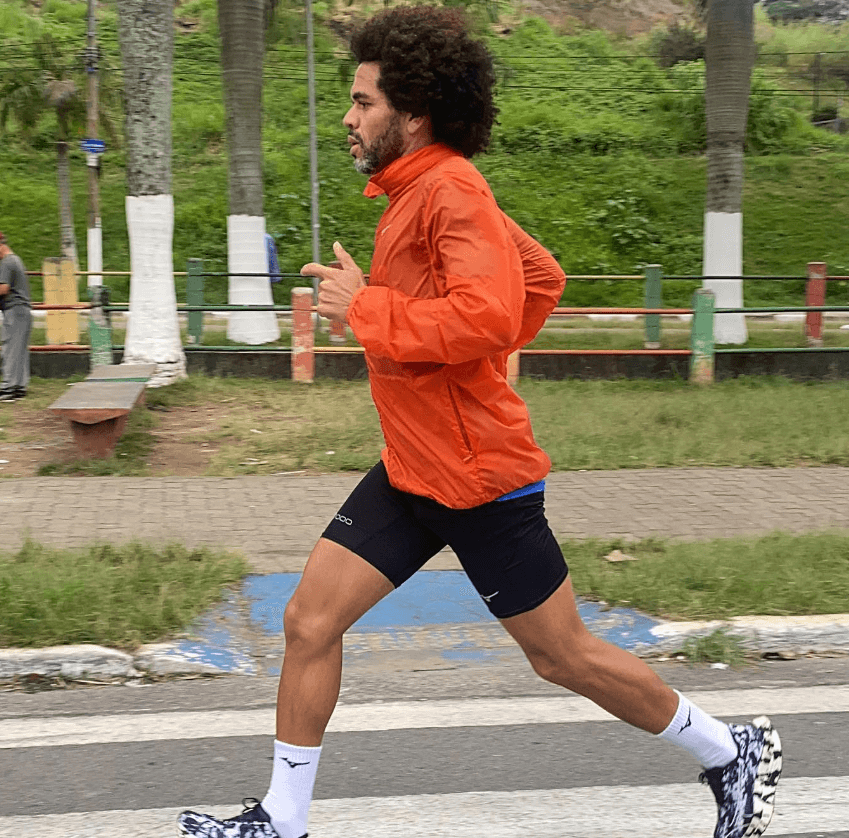

Afonso é um profissional dedicado ao universo da corrida, com um foco especial na biomecânica e na nutrição esportiva. Como ex-atleta e formado em Fisioterapia, Afonso entende profundamente a importância de um bom par de tênis e uma dieta balanceada para um desempenho de corrida otimizado