Cryptocurrency rate

Related Links Are you ready to learn more? Visit our glossary and crypto learning center. Are you interested in the scope of crypto assets? Investigate our list of cryptocurrency categories. https://casino-888.org Are you interested in knowing which the hottest dex pairs are currently?

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

NewsNow aims to be the world’s most accurate and comprehensive crypto news aggregator, bringing you today’s latest headlines from the best alt coins and crypto news sites. Whether it’s Bitcoin, Dogecoin, Diem, Ethereum or Ripple, Monero, Litecoin, Dash or NEM, we’ve got it covered.

Best cryptocurrency to buy

BTC boasts the most mainstream acceptance of any of the top cryptocurrencies, as evidenced by the January debut of 11 new Bitcoin exchange-traded funds, or ETFs. The fight with the Securities and Exchange Commission to approve spot Bitcoin ETFs was years in the making, but the approval finally materialized. Bitcoin ETFs have ushered in a new chapter for the leading crypto, as mainstream investors can now track its performance without having to directly own the “digital gold” itself.

BTC boasts the most mainstream acceptance of any of the top cryptocurrencies, as evidenced by the January debut of 11 new Bitcoin exchange-traded funds, or ETFs. The fight with the Securities and Exchange Commission to approve spot Bitcoin ETFs was years in the making, but the approval finally materialized. Bitcoin ETFs have ushered in a new chapter for the leading crypto, as mainstream investors can now track its performance without having to directly own the “digital gold” itself.

Bitcoin’s price has skyrocketed as it’s become a household name. In May 2016, you could buy one bitcoin for about $US500. As of September 24, 2024 (five months after the most recent bitcoin halving event occurred) a single bitcoin’s price was around $US63,527. That’s a growth of more than 12,600%.

One of the factors that could help Ethereum reach higher in the near future is the resurgence in the popularity of Ethereum-based meme coins. This year, we’ve seen the meme coin sector being primarily dominated by meme coins issued on the Solana blockchain, which was reflected in record DEX volume on Raydium and other Solana decentralized marketplaces.

What’s more, Cardano developer Emurgo has partnered with BitcoinOS to allow Cardano DeFi to tap into the trillion-dollar Bitcoin liquidity without intermediaries. BitcoinOS is a smart contract operating system for Bitcoin that uses zero-knowledge proofs (ZKPs) to enable Bitcoin to scale efficiently without sacrificing decentralization or security.

Another crypto to watch is one that aims to provide a decentralized platform for building and executing smart contracts. It’s been gaining traction due to its unique approach to solving the scalability issue that plagues many blockchain platforms.

Best cryptocurrency

When we first think of crypto, we usually think of bitcoin first. That’s because bitcoin represents more than 54% of the total cryptocurrency market. So when we talk about any cryptos outside of bitcoin, all of those cryptos are considered altcoins.

Unlike some other forms of cryptocurrency, Tether (USDT) is a stablecoin pegged to the value of US$1. This is achieved by having a 1-1 backing between the token and USD which hypothetically keeps a value equal to one of those denominations because one token should always be able to be redeemed for one dollar. In theory, this means Tether’s value is supposed to be more consistent than other cryptocurrencies, and it’s favoured by investors who are wary of the extreme volatility of other coins.

For smaller alternative cryptocurrencies or altcoins, there can be noticeable price discrepancies across different exchanges. At CoinCodex, we weigh the price data by volume so that the most active markets have the biggest influence on the prices we’re displaying.

While some cryptocurrencies have seen massive gains in the past, predicting what coin might pull a 1000x return is impossible. For a digital asset to pull this kind of gain, it would have to be a very small, high-risk project. Investors should thoroughly research any cryptocurrency, understand the risks, and never invest more than they can afford to lose.

Cryptocurrency prices

EIP-1559 also introduces a fee-burning mechanism. A part of every transaction fee (the base fee) is burned and removed out of circulation. This is intended to lower the circulating supply of Ether and potentially increase the value of the token over time.

Since its inception, Ethereum has maintained its spot as the second-largest cryptocurrency by market capitalization. But like every other blockchain network that exists, Ethereum is not perfect. Notable, the legacy blockchain is plagued with high gas fees and low throughput of between 15 to 30 transactions per second.

As already mentioned, there are plans to transition to a proof-of-stake algorithm in order to boost the platform’s scalability and add a number of new features. The development team has already begun the transition process to ETH 2.0, implementing some upgrades along the way, including the London hard fork.

The biggest Ethereum upgrade since The Merge, the Shanghai Upgrade will allow ETH stakers to unstake their ETH and withdraw ETH rewards from the Beacon Chain. During The Merge, the Ethereum proof-of-work chain merged with the proof-of-stake Beacon Chain. Instead of mining, validators stake 32 ETH to secure the network. However, stakers are unable to unstake and withdraw until the Shanghai Upgrade.

After the Ethereum 2.0 Beacon Chain (Phase 0) went live in the beginning of December 2020, it became possible to begin staking on the Ethereum 2.0 network. An Ethereum stake is when you deposit ETH (32 ETH is required to activate validator software) on Ethereum 2.0 by sending it to a deposit contract, thus helping to secure the network by storing data, processing transactions and adding new blocks to the blockchain. At the time of writing in mid-September 2021, the Ethereum price now for 32 Ether is roughly $116,029. The amount of money earned by Ethereum validators right now is a return of 6% APR, which equates to around 1.91952 ETH, or $6960 in Ethereum price today. This number will change as the network develops and the amount of stakers (validators) increase.

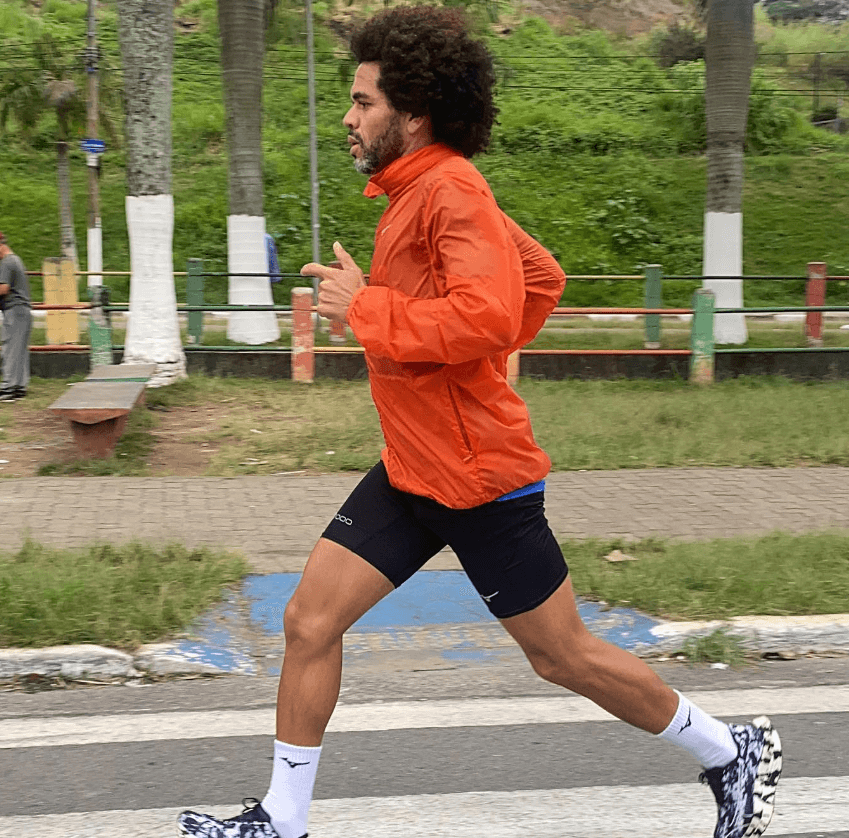

Afonso é um profissional dedicado ao universo da corrida, com um foco especial na biomecânica e na nutrição esportiva. Como ex-atleta e formado em Fisioterapia, Afonso entende profundamente a importância de um bom par de tênis e uma dieta balanceada para um desempenho de corrida otimizado